Summary

- Dell shares continue to trade at a deep discount.

- Multiple levers available to drive EBITDA expansion.

- Shares to trade up to ~$85 on EBITDA expansion, though a successful deleveraging scenario could unlock even more value.

With "new" Dell (DELL) currently trading far below its mid-year peak, I think consensus is missing the deleveraging story here. Core Dell remains highly free cash flow generative, and even assuming revenue and operating income in line with consensus; there is plenty of room for the company to beat on EPS solely based on the interest line going into 2020. In a successful debt paydown scenario, I believe consensus will re-adjust accordingly, which should boost consensus EPS higher and force a re-rating. Shares also offer investors additional margin of safety through a sum-of-parts discount, which implies a deeply discounted "core Dell" at current prices. I think shares could potentially trade up to ~$85 on EBITDA expansion, though this could prove conservative down the line as the deleveraging story plays out.

Stronger end markets

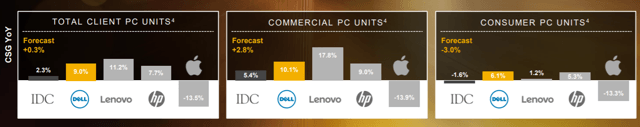

Though the PC market is likely in secular decline, Dell is still extracting growth across the client (+9.0% YoY), commercial (+10.1% YoY), and consumer (+6.1% YoY) segments. Though the broader PC space is unlikely to turn around, continued share gains should continue for Dell as PC demand continues to consolidate among the top vendors.

Source: Analyst Meeting Presentation

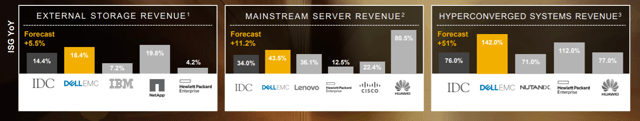

Servers, on the other hand, offer more exciting prospects - Dell EMC is outperforming a fast-growing space, posting strong growth numbers across external storage (+18.4% YoY), mainstream servers (+43.5% YoY), and hyper-converged systems (+142.0% YoY).

Source: Analyst Meeting Presentation

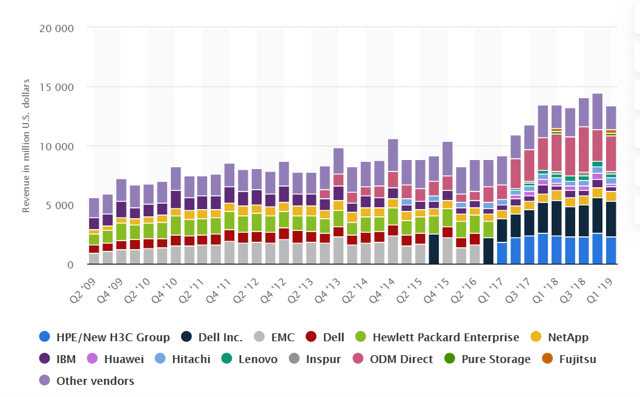

The acquisition of EMC has opened up a new growth avenue for Dell, creating a "one-stop-shop" for data center products pulling Dell's servers. Though there was some share loss in storage in the aftermath of the EMC acquisition, Dell has gained back share in recent quarters, having addressed some of its product and go-to-market issues.

Source: Statista

I see little reason for the company's recent share gains in storage to slow, especially as it continues to rationalize its product portfolio in pursuit of innovation.

"We looked at the market needs and we have built the next generation roadmap that simplifies what we do in a very significant way...And the result is pretty staggering. In many cases we have two to three times more developers today working on the new stuff, the things on the far right-hand side of the chart than we did a year ago, driving a higher level of innovation than we've ever had."

It's also important to keep the broader context in mind - the next compute cycle is increasingly looking to be data-driven, and technologies such as AI, IoT, and blockchain are extremely data-intensive, requiring IT investments to collect information from new sources and processes with richer compute.

Dell as a group (EMC, VMware, Pivotal, RSA, etc.) is well-equipped to provide the infrastructure and services needed to fulfill CIO needs at the edge, core, and cloud as we enter a data-driven investment cycle.